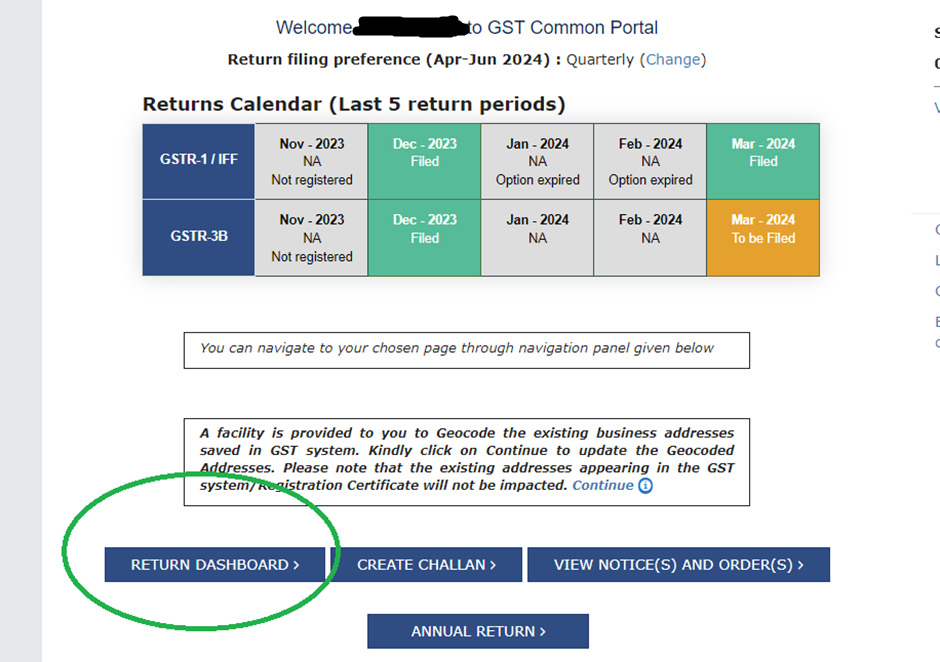

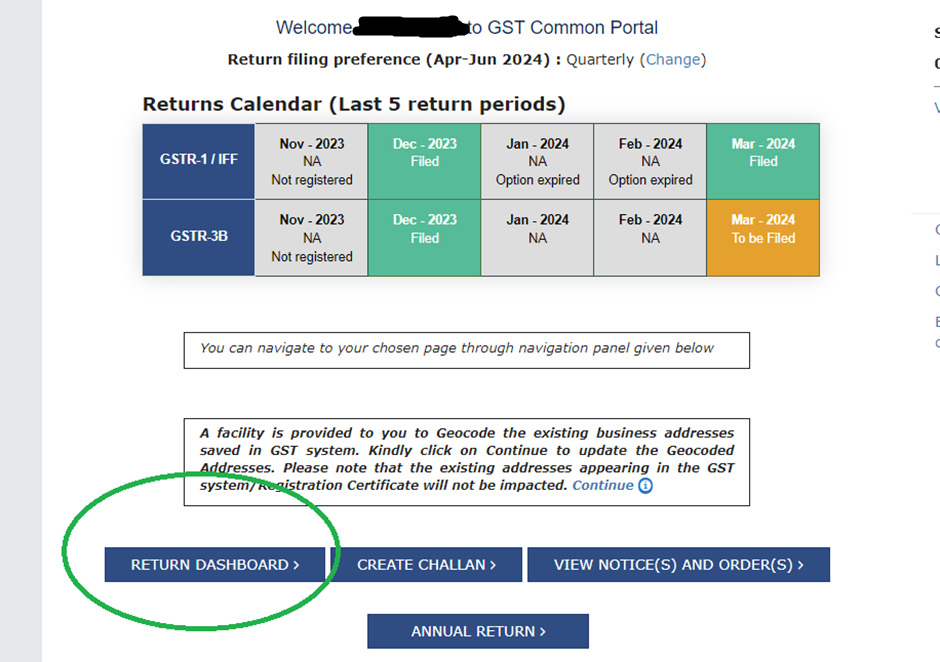

1. Login at GST portal (https://services.gst.gov.in/services/login) > Click Return Dashboard

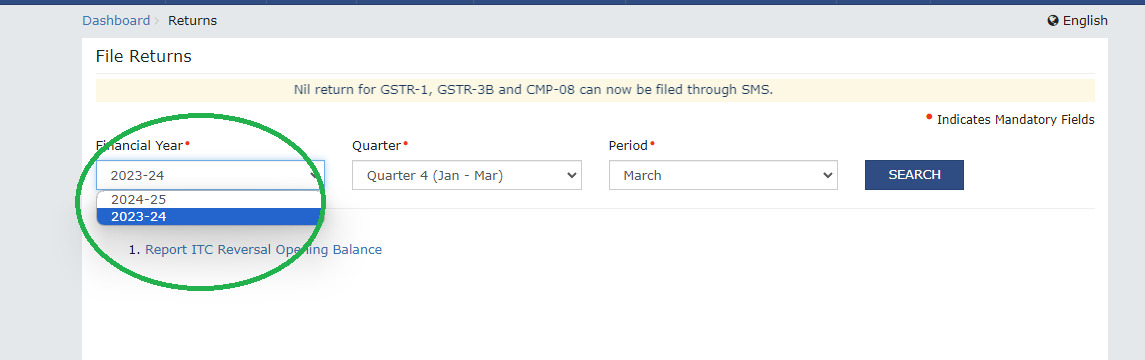

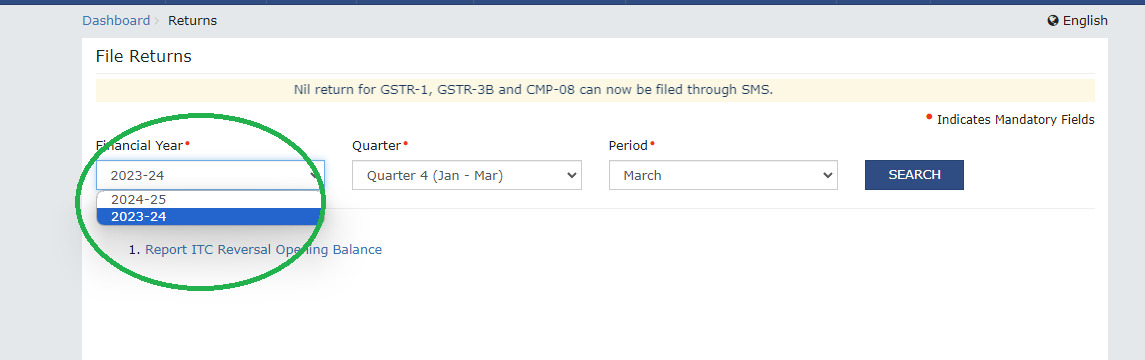

2. Select Relevant Period (Ex. FY 2023-2024 – Q4 – March) > Click Search

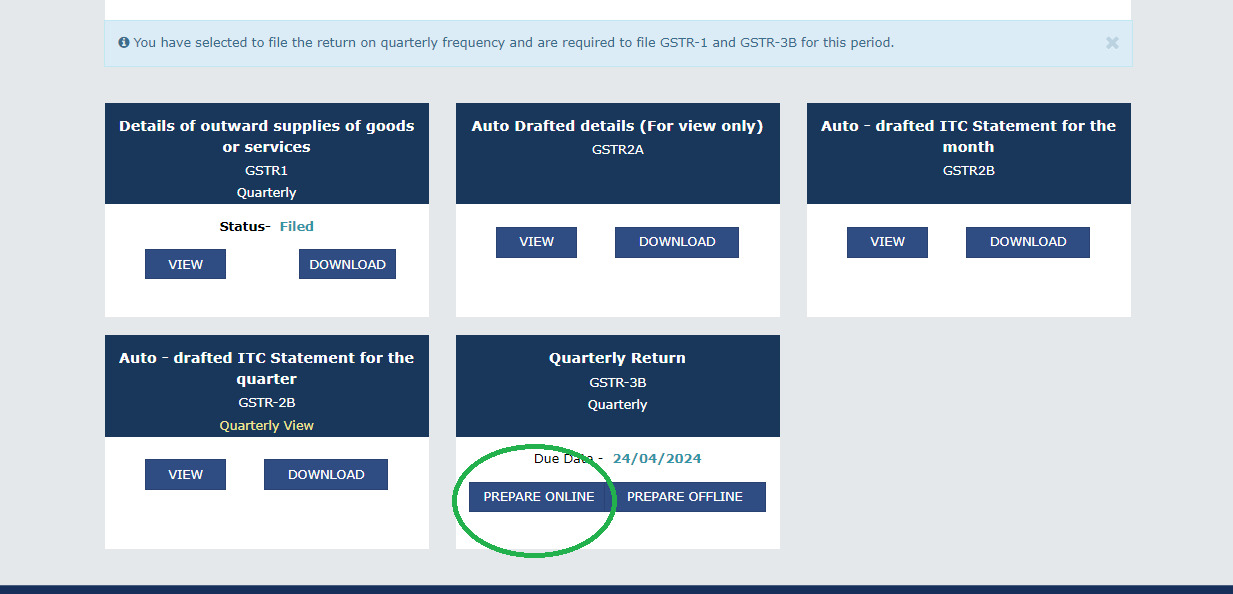

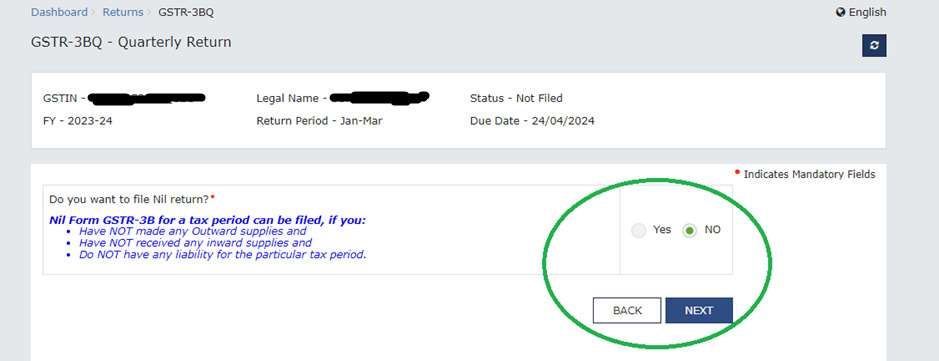

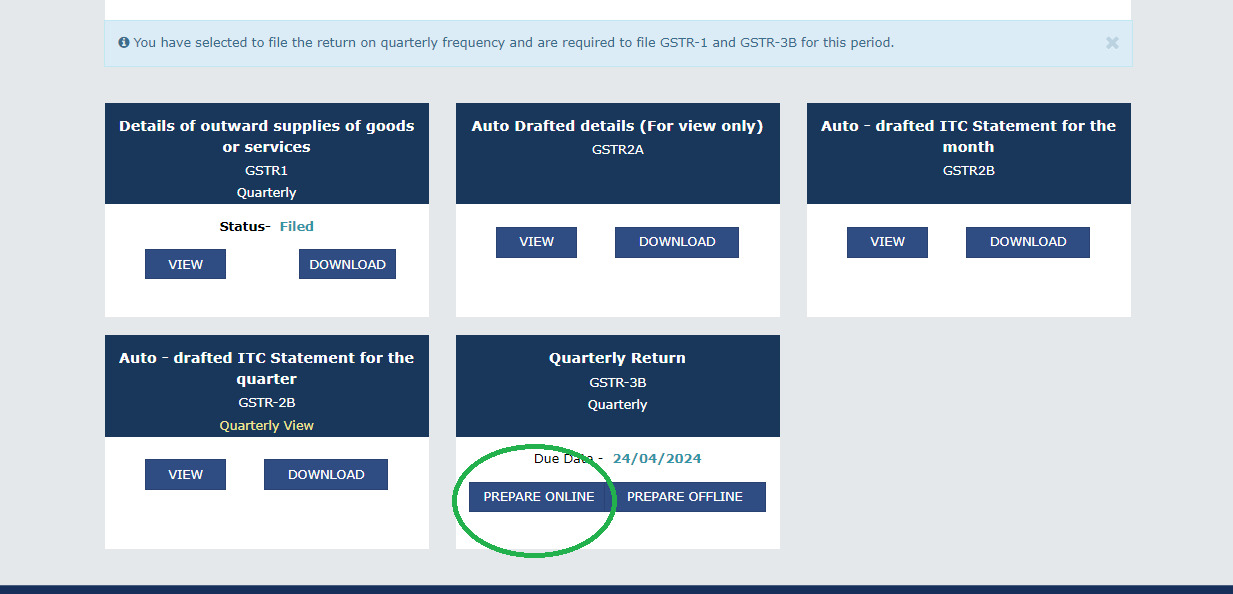

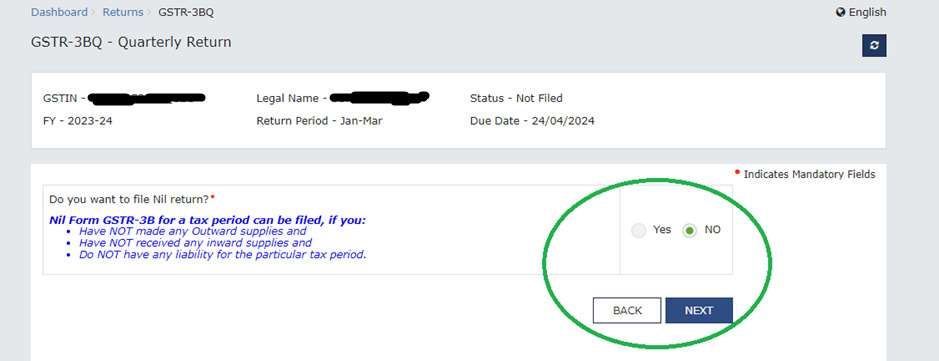

3. Under GSTR3B click Prepare Online and click Next (While No is selected about NIL filing)

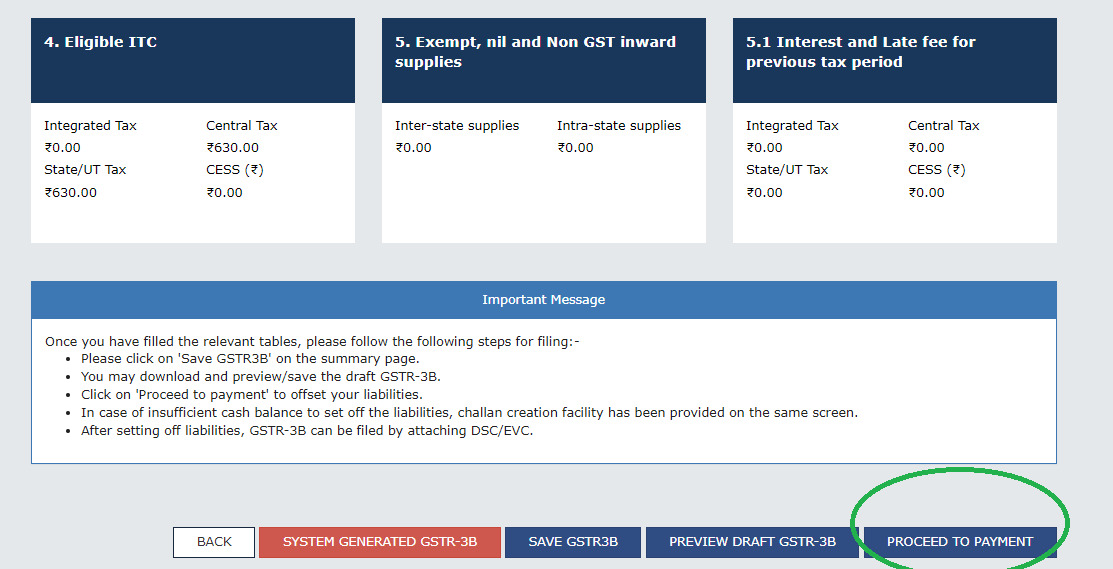

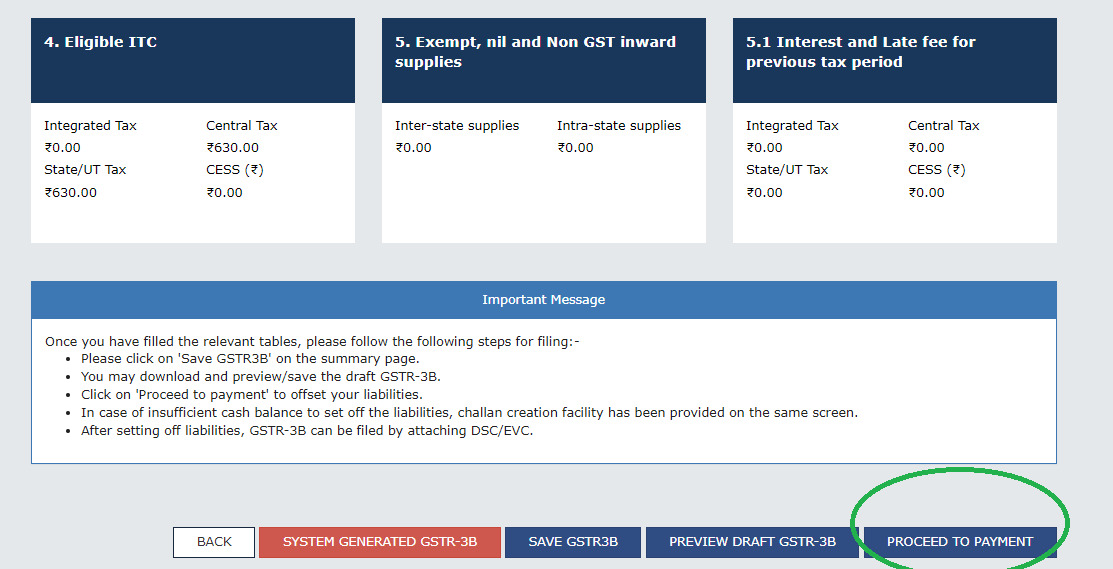

4. Close the pop up, scroll down and click Proceed to Payment

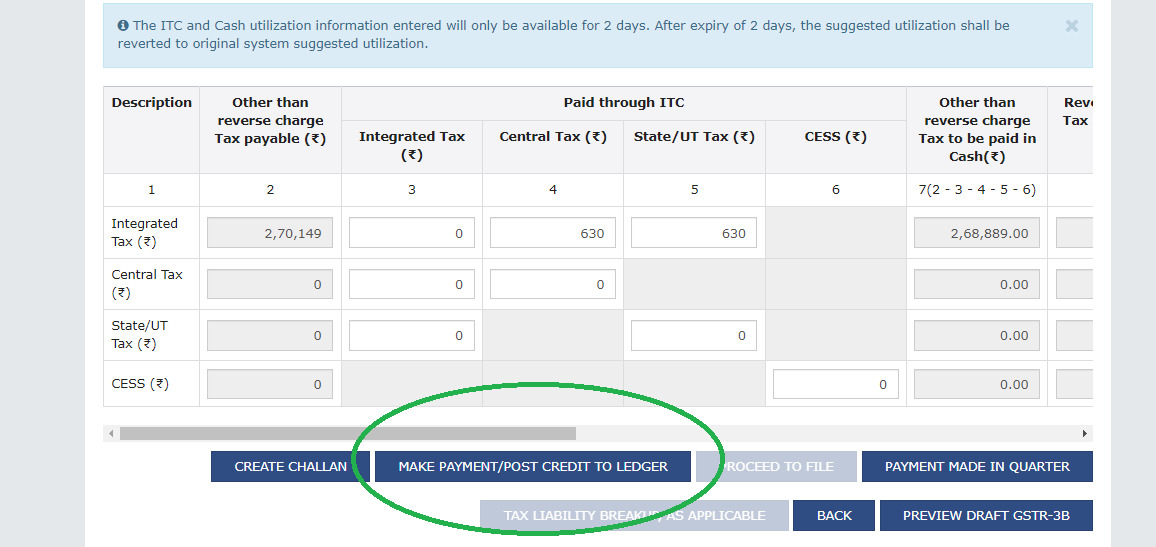

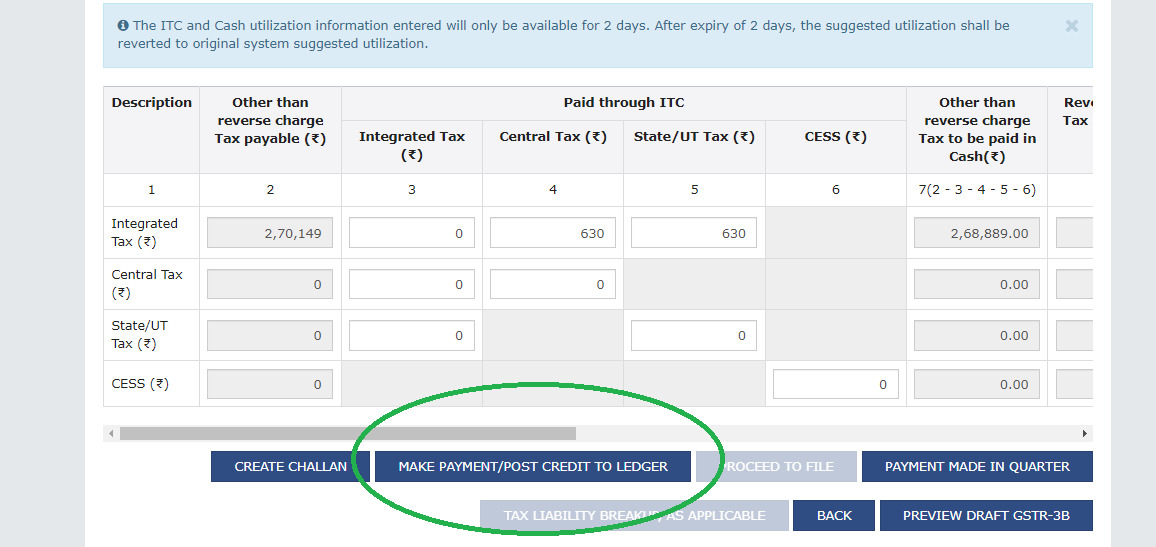

5. Scroll down and click Make Payment/Post Credit to Ledger and Click Yes on the warning pop up

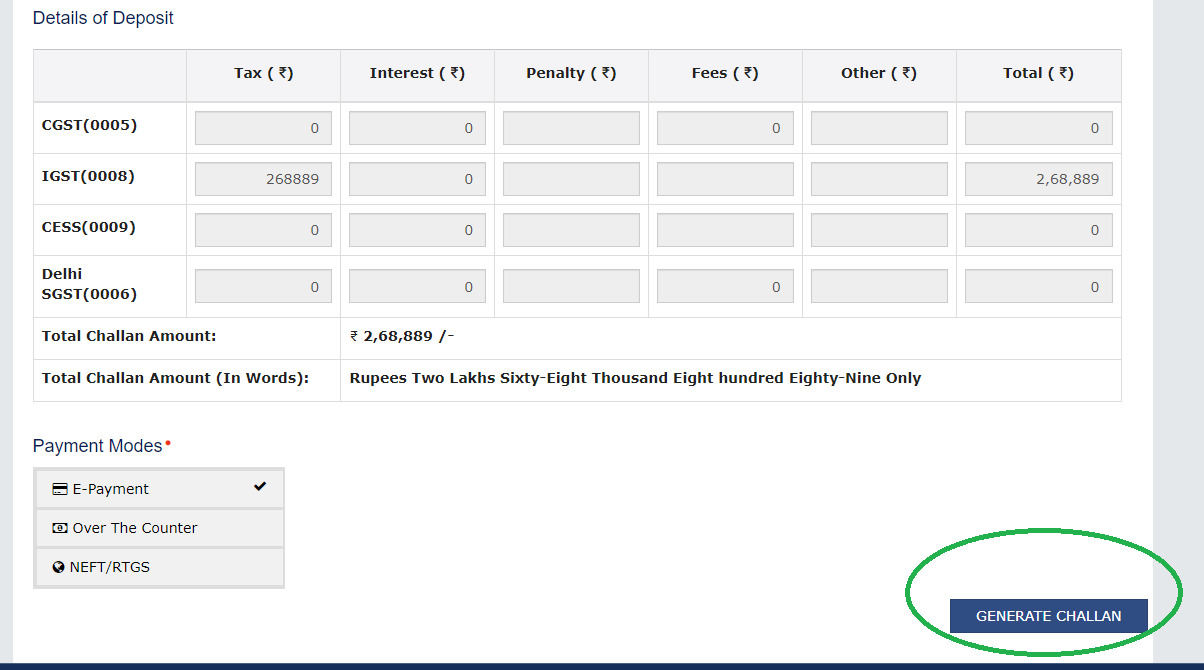

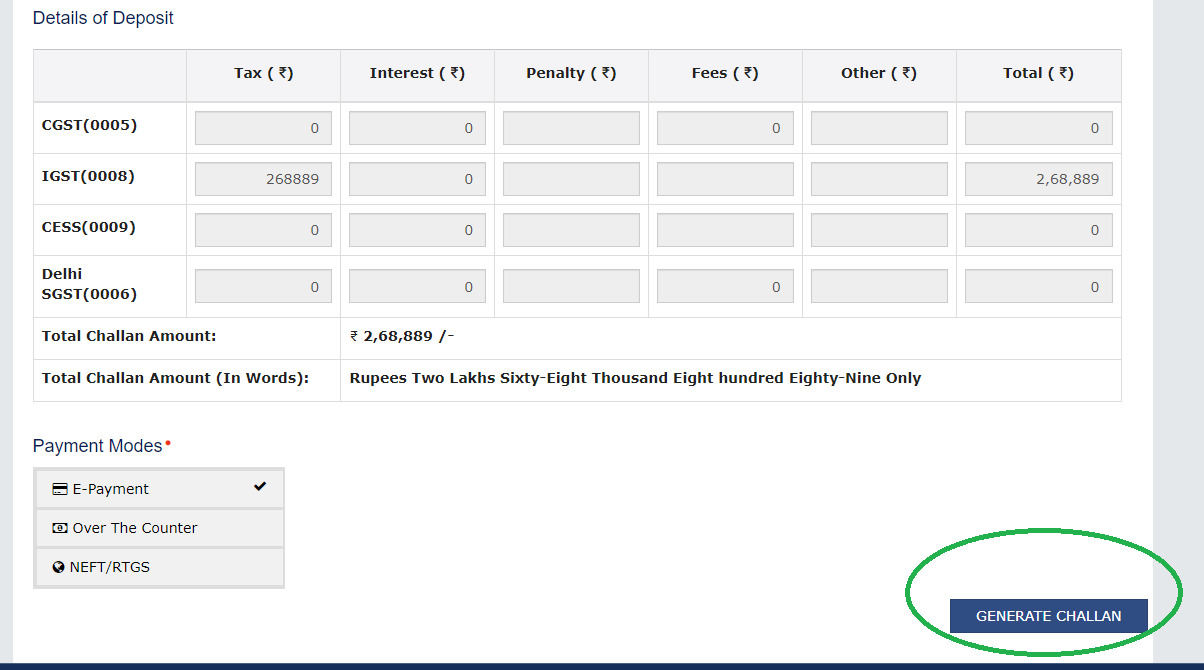

6. Select E-Payment and Click on Generate Challan

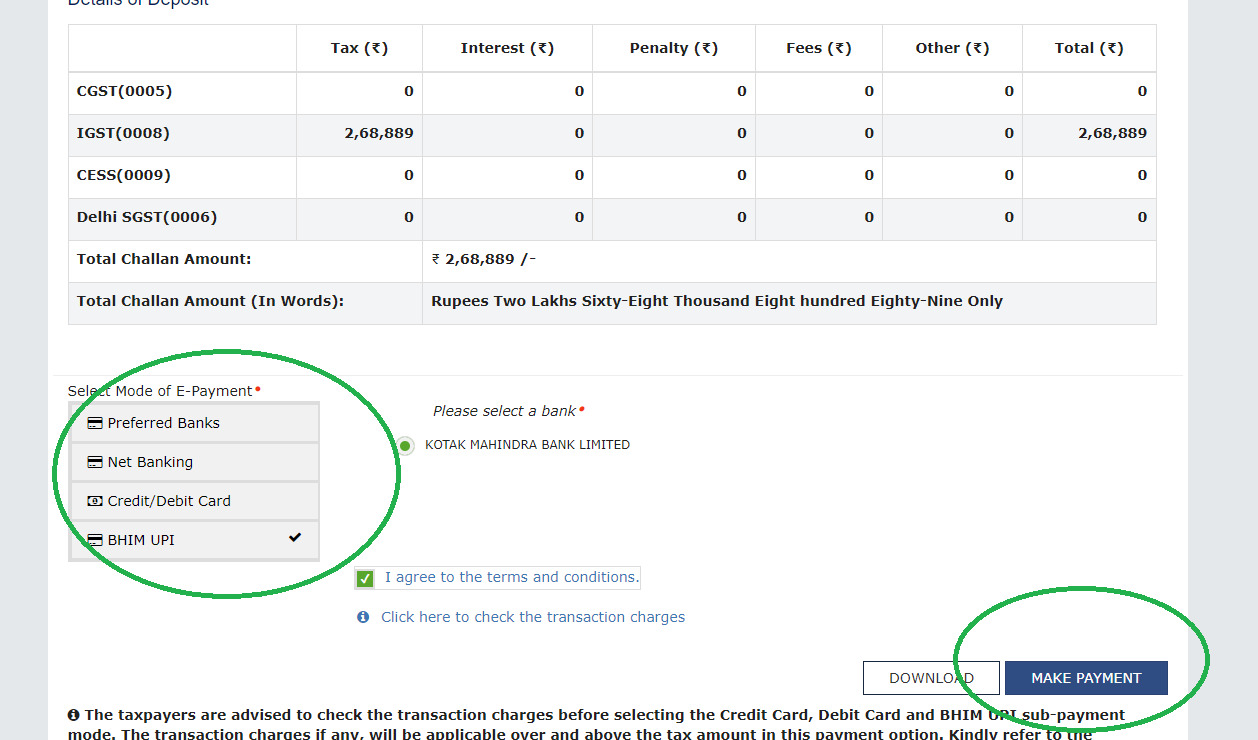

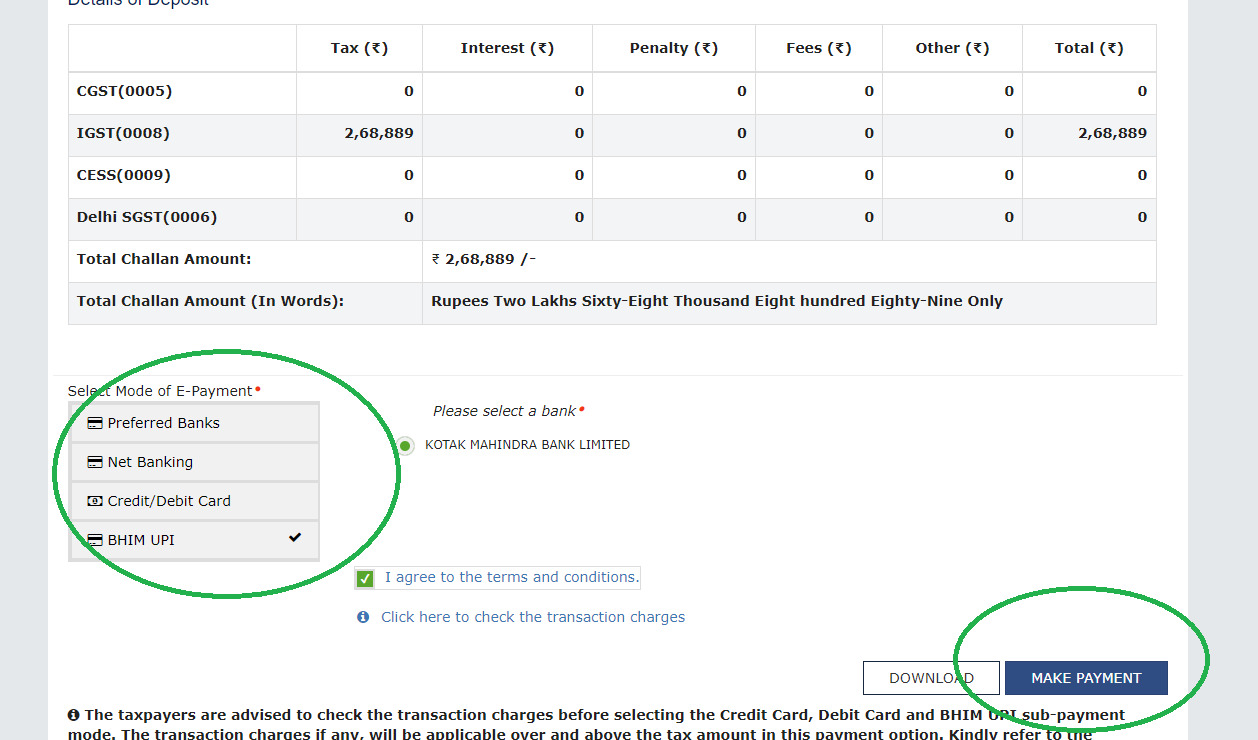

7. Select Mode of Payment and click Make Payment

8. Make the payment on the banking website. Once payment is done, GST portal will show a success page. Voila, the payment is done. Inform your compliance team to proceed with filing.

Share This post!

1. Login at GST portal (https://services.gst.gov.in/services/login) > Click Return Dashboard

2. Select Relevant Period (Ex. FY 2023-2024 – Q4 – March) > Click Search

3. Under GSTR3B click Prepare Online and click Next (While No is selected about NIL filing)

4. Close the pop up, scroll down and click Proceed to Payment

5. Scroll down and click Make Payment/Post Credit to Ledger and Click Yes on the warning pop up

6. Select E-Payment and Click on Generate Challan

7. Select Mode of Payment and click Make Payment

8. Make the payment on the banking website. Once payment is done, GST portal will show a success page. Voila, the payment is done. Inform your compliance team to proceed with filing.