You may be aware that the Ministry of Corporate Affairs is live with MCA21 V3 system. As part of the revised process, for undertaking any e-filing service or DSC registration/association service, it is a pre-requisite that the user is registered as a “Business User” on the MCA21 portal.

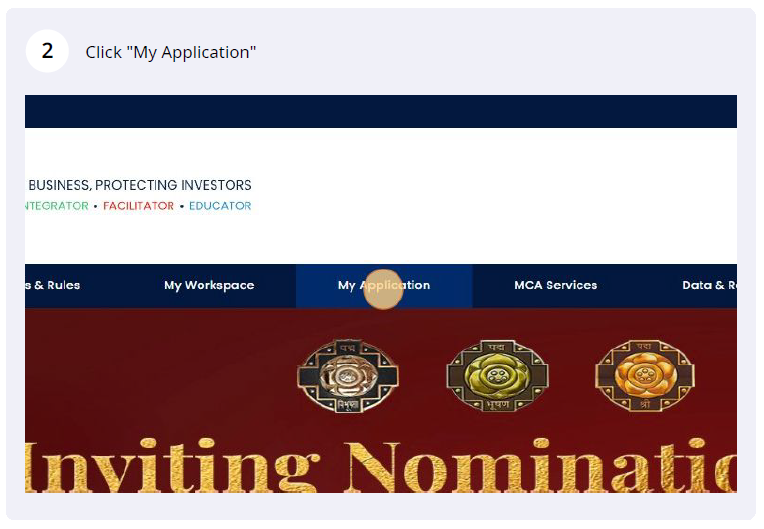

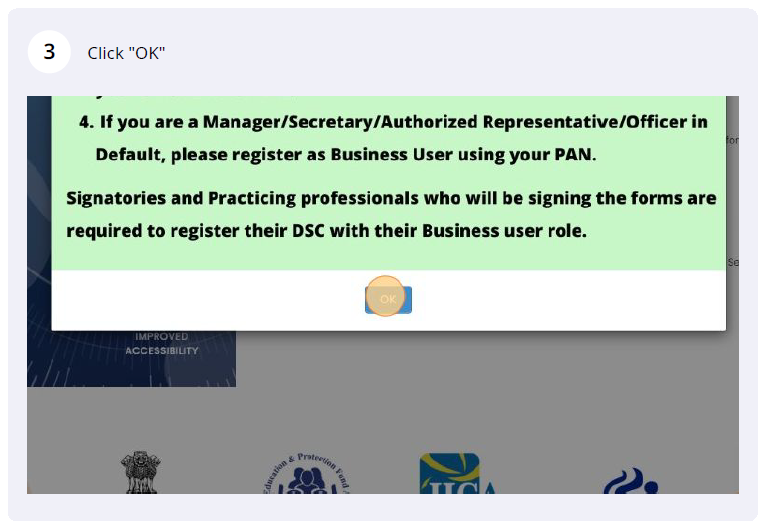

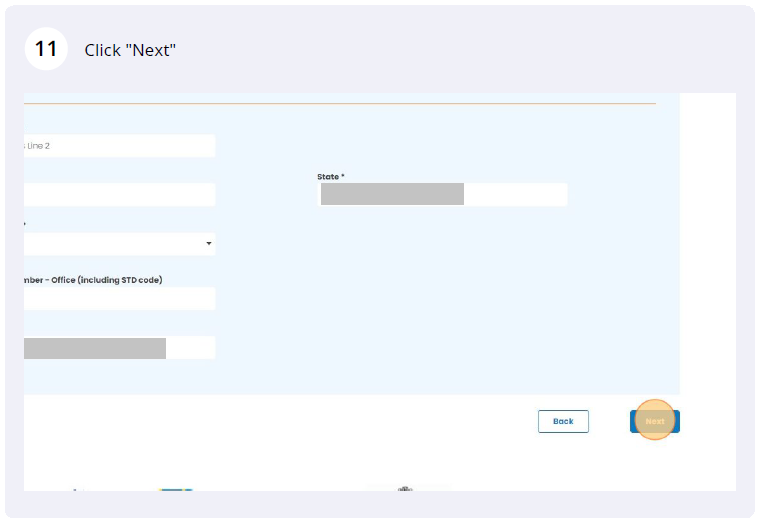

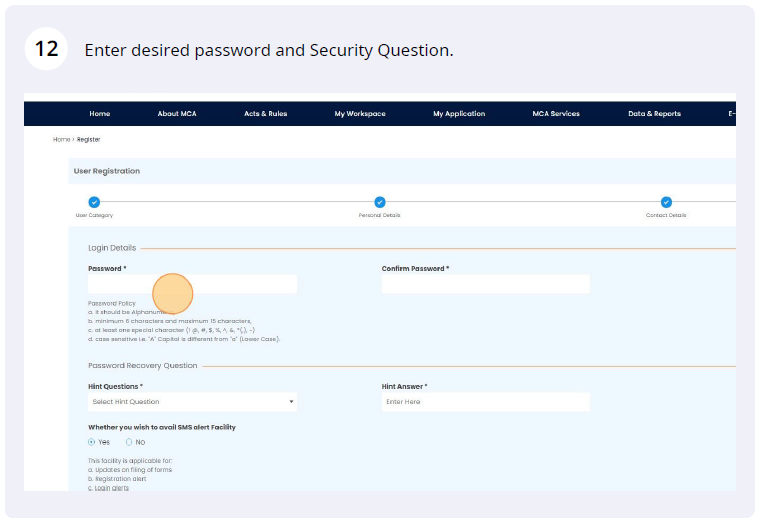

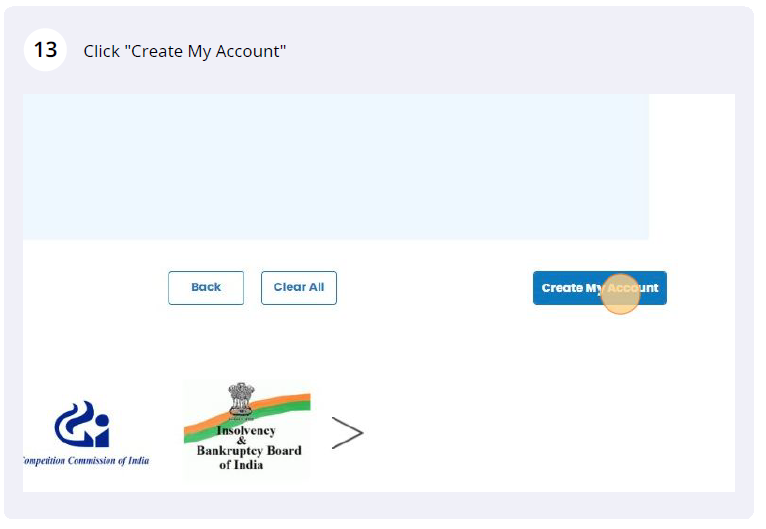

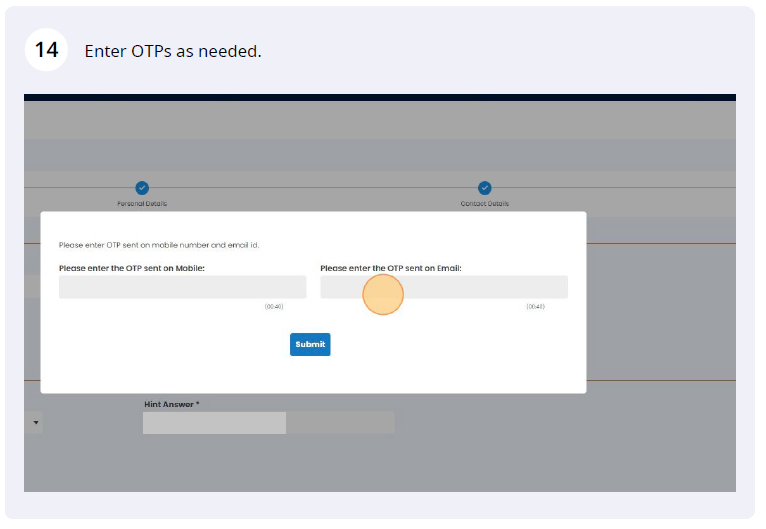

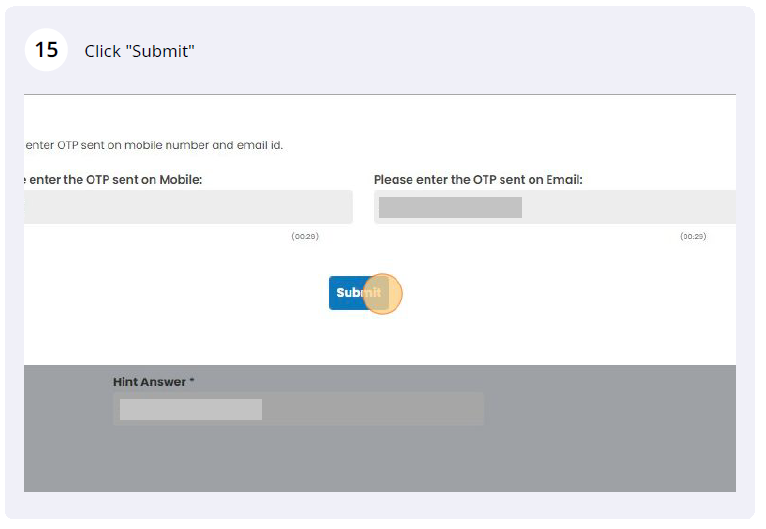

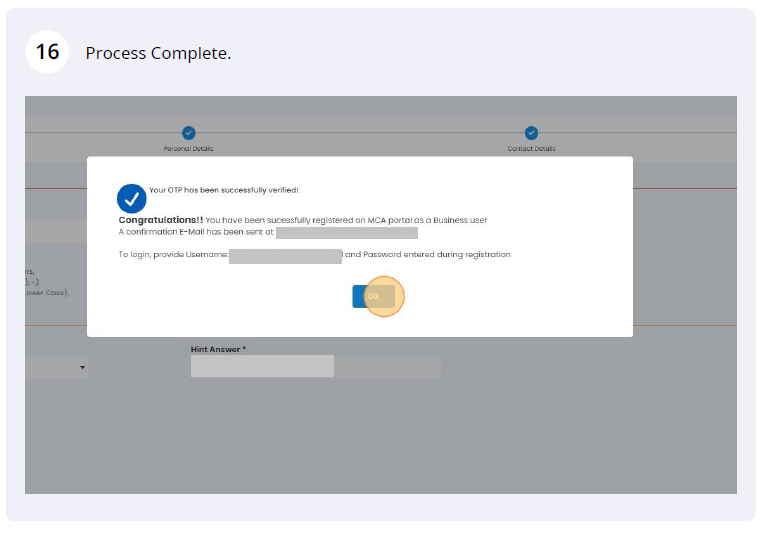

Please go through the step by step guide to create your Business User account on MCA21 Portal. This activity is required to be completed by every Director/Designated Partner individually.

Further, before registering on the new portal please note the following points:

a.) If you are an existing MCA user & have a valid “user Id” and “password” to transact on MCA portal. Please log in using your existing id.

b.) Once you have successfully logged in, please go to the profile update page in the top right corner under user name. It will show details of your existing accounts such as type of user and personal details.

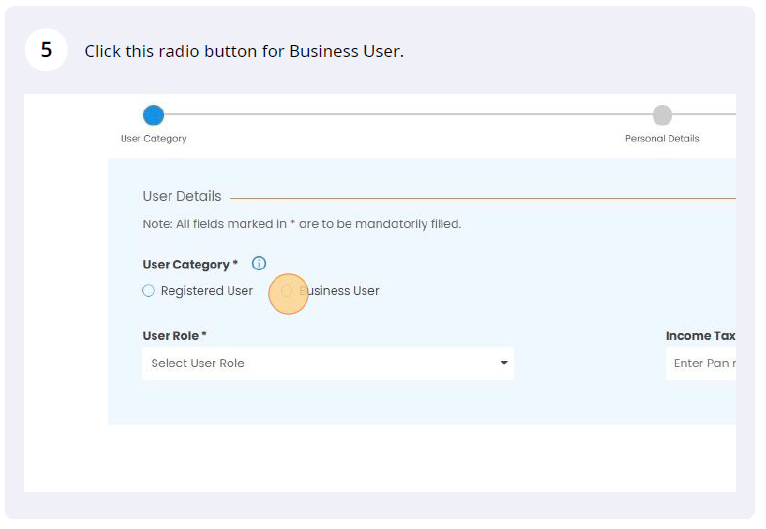

c.) If your user type is “Registered”, please edit your profile to become Business User – Director/Designated Partner.

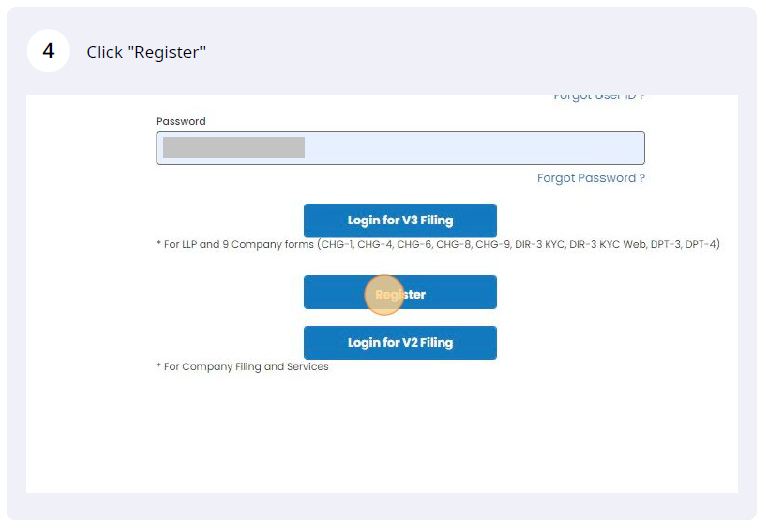

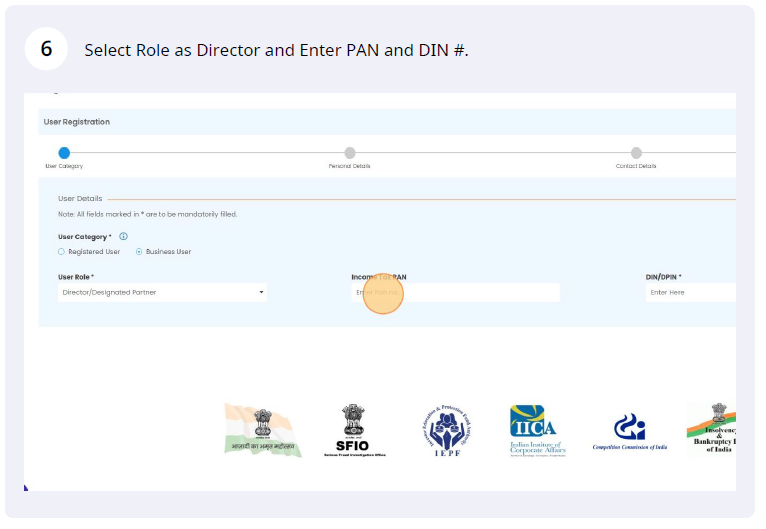

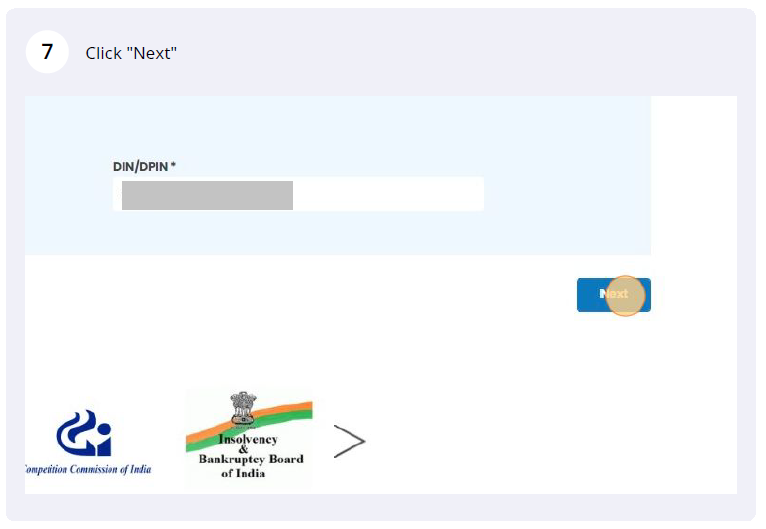

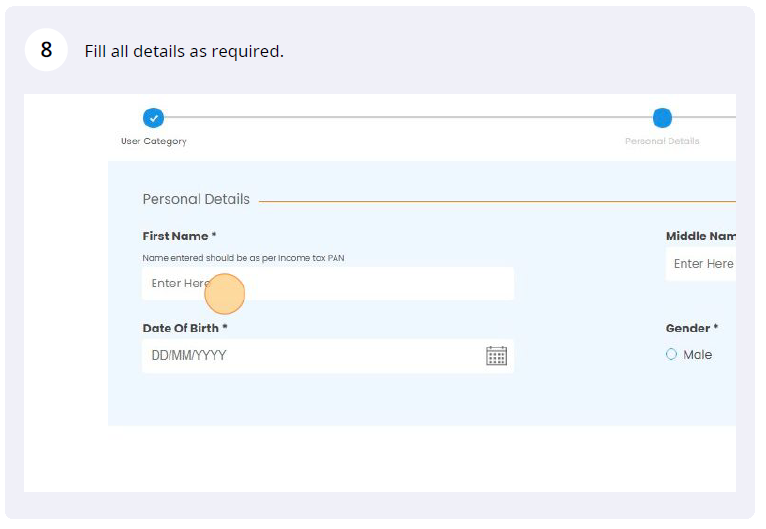

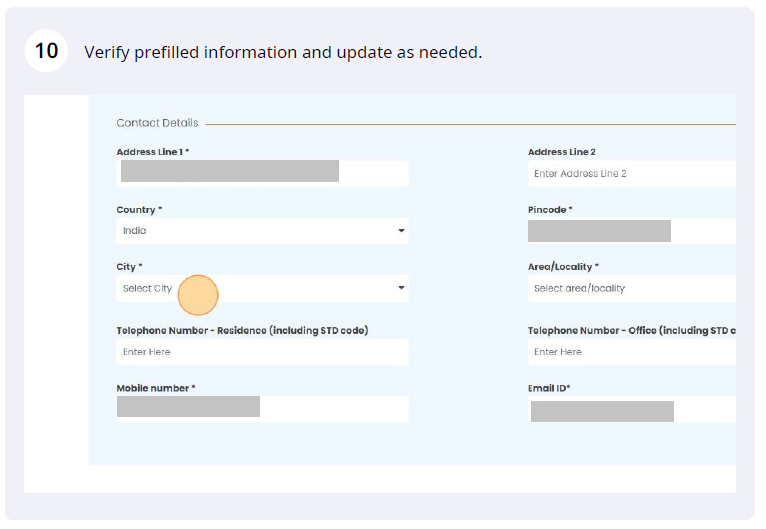

d.) If you are new to MCA portal, please register as a business user under the “Director/Designated Partner” role by following the registration process.

Once you are registered as Business user – Director/Designated Partner role, another important step, another important thing to complete is DIR 3 KYC Web OTP verification. Once you are logged in, please navigate to MCA Services -> Company e-Filing -> DIN Related Filings -> ” Form DIR-3-KYC Web – Verify Director’s KYC Details ” and follow the OTP based verification process and complete the online submission.

Please note: OTP based DIR3KYC Web is only available for Directors whos DIR-3KYC was filed for the previous or earlier year. For First year/time DIR3KYC, there is another eform to be followed which needs to be certified by a professional (CA/CS). This Compliance process is mandatory and needs to be completed by each Director/Designated Patner holding DIN/DPIN on closure of every financial year by 30th September to avoid penalty of ₹ 5000.

Share This post!

You may be aware that the Ministry of Corporate Affairs is live with MCA21 V3 system. As part of the revised process, for undertaking any e-filing service or DSC registration/association service, it is a pre-requisite that the user is registered as a “Business User” on the MCA21 portal.

Please go through the step by step guide to create your Business User account on MCA21 Portal. This activity is required to be completed by every Director/Designated Partner individually.

Further, before registering on the new portal please note the following points:

a.) If you are an existing MCA user & have a valid “user Id” and “password” to transact on MCA portal. Please log in using your existing id.

b.) Once you have successfully logged in, please go to the profile update page in the top right corner under user name. It will show details of your existing accounts such as type of user and personal details.

c.) If your user type is “Registered”, please edit your profile to become Business User – Director/Designated Partner.

d.) If you are new to MCA portal, please register as a business user under the “Director/Designated Partner” role by following the registration process.

Once you are registered as Business user – Director/Designated Partner role, another important step, another important thing to complete is DIR 3 KYC Web OTP verification. Once you are logged in, please navigate to MCA Services -> Company e-Filing -> DIN Related Filings -> ” Form DIR-3-KYC Web – Verify Director’s KYC Details ” and follow the OTP based verification process and complete the online submission.

Please note: OTP based DIR3KYC Web is only available for Directors whos DIR-3KYC was filed for the previous or earlier year. For First year/time DIR3KYC, there is another eform to be followed which needs to be certified by a professional (CA/CS). This Compliance process is mandatory and needs to be completed by each Director/Designated Patner holding DIN/DPIN on closure of every financial year by 30th September to avoid penalty of ₹ 5000.